When people talk about wealth building, they often mention saving, investing, or budgeting. But behind all of these lies one powerful concept that can quietly transform your financial future, compound interest.

Many call it the eighth wonder of the world, and for good reason. Once you understand how it works, you’ll see why it’s often described as your secret weapon for financial freedom.

What Is Compound Interest?

Simply put, compound interest is interest earned on both your original money (principal) and the interest that money has already made. Unlike simple interest, where you only earn interest on the initial amount, compound interest allows your money to grow at a much faster pace.

Think of it like planting a tree. With time, the tree grows and produces fruits. If you plant some of those fruits back into the soil, you don’t just have one tree, you now have several trees producing more fruits. That’s exactly how compounding works with your money.

Why Is Compound Interest So Powerful?The secret lies in time and reinvestment. The longer your money stays invested, the more cycles of growth it goes through. This creates a snowball effect where your wealth keeps building on itself.

Key benefits include:

Exponential Growth: Small amounts grow into large sums over time.

Passive Wealth Creation: Your money works for you, even while you sleep.

Encourages Consistency: The earlier and more regularly you invest, the better the results.

Beats Inflation: Over time, compound growth can outpace rising costs of living.

Real-World Example: Saving Early vs Saving Late

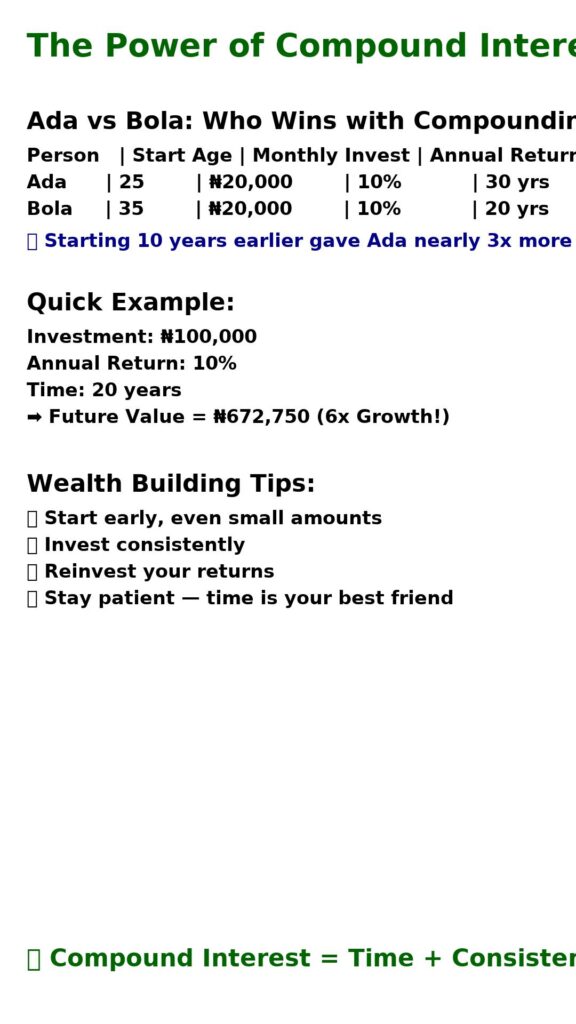

Let’s illustrate with two friends: Ada and Bola.

Ada starts investing ₦20,000 every month at age 25 with a 10% annual return.

Bola waits and starts the same ₦20,000 monthly investment at age 35 with the same return.

By the time both turn 55:

Ada’s investment grows to about ₦45 million.

Bola’s investment grows to only about ₦16 million.

Even though Bola invested for 20 years, she ends up with far less because she started later. That’s the magic of time + compounding.

Simple Calculation to Understand Compound Interest

The formula for compound interest is:

A = P (1 + r/n) ^ nt

Where:

A = Future value of investment

P = Principal (your starting amount)

r = Annual interest rate (in decimal form)

n = Number of times interest is compounded per year

t = Time in years

For example:

If you invest ₦100,000 at 10% annual return, compounded yearly for 20 years, it grows into:

A = 100,000 (1 + 0.10/1) ^ (1×20) = ₦672,750

That’s over six times your money, without doing anything extra!

Practical Ways to Use Compound Interest for Wealth Building

Start Early: Even small amounts add up with time.

Invest Regularly: Consistency is key to growth.

Reinvest Your Returns: Don’t withdraw your interest too soon.

Choose Growth Assets: Stocks, mutual funds, and retirement accounts often offer compounding.

Avoid Debt with High Interest: Remember, compounding also works against you if you owe money.

Think Long-Term: The longer you stay invested, the more powerful compounding becomes.

Set Financial Goals: Link your compounding investments to future needs like retirement or education.

Stay Patient and Disciplined: Wealth building takes time.

Everyday Life Example

Imagine you put ₦500 daily into an investment that earns 10% annually. In one year, that’s ₦182,500 saved. But after 20 years of compounding, that grows into over ₦11 million.

That’s how ordinary people build extraordinary wealth, slowly, consistently, and with the power of compound interest.

Conclusion

Compound interest is not just a financial formula. It’s a lifestyle choice. Whether you’re saving for retirement, your children’s education, or simply financial freedom, starting early and letting your money grow can completely change your future.

Instead of waiting for the “perfect time,” begin now. Even the smallest step today can lead to massive results tomorrow.

Don’t just read about it, start applying it today. Open that savings or investment account, commit to a small daily or monthly contribution, and let compound interest do the heavy lifting.

Share this post with friends and family so they too can unlock the power of compounding.

Subscribe to our blog for more wealth-building tips, personal finance strategies, and financial freedom guides.